The advancements in city logistics are fostering a rise in smaller, time-sensitive deliveries. Over the past decade, the parcel market has expanded, driven by emerging business models like ship-from-store (B2C and B2B) and quick commerce. Additionally, companies are increasingly emphasizing sustainability. To tackle the challenges of quicker delivery demands, clean transportation (low/zero-emission), and limited space in densely populated cities, the Light Electric Freight Vehicle (LEFV) emerges as an innovative solution.

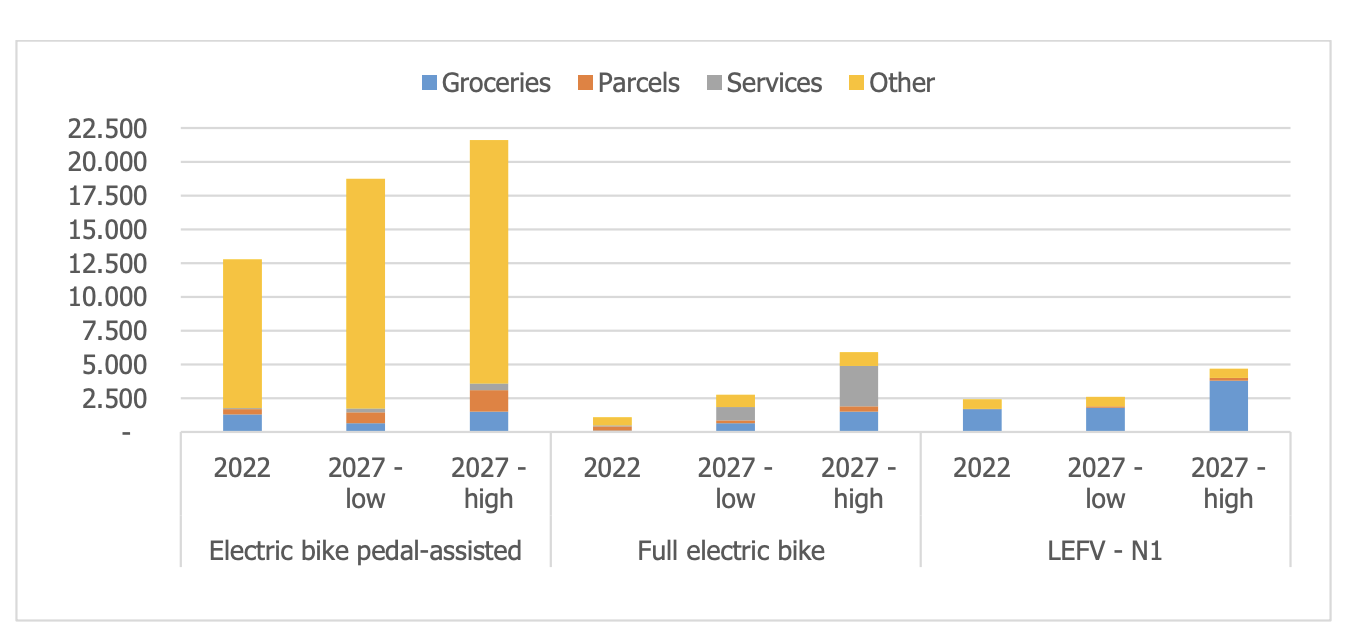

A recent study in the Netherlands delves into LEFVs, encompassing all vehicles with logistics applications, ranging from pedal-assisted cargo bikes to light electric vans (LEFV-N1). The focus is on fresh goods delivery, parcel delivery, service logistics, and construction logistics for urban applications. The study focuses on factors influencing the potential growth of various LEFV types in the Netherlands across these applications in the next decade.

The methodology involves desk research, validation through workshops, quantitative analysis, and interviews with users, legislators, manufacturers, and dealers/leasing companies. The study’s findings include identifying trends, developments, vehicle characteristics, legal frameworks, potential growth opportunities for LEFVs, policies governing LEFV deployment, user profiles, reasons for deployment, and an estimated count of LEFVs in 2027. This count distinguishes between cannibalization on N1 and the number of LEFVs entering new (and partly currently non-existent) markets.

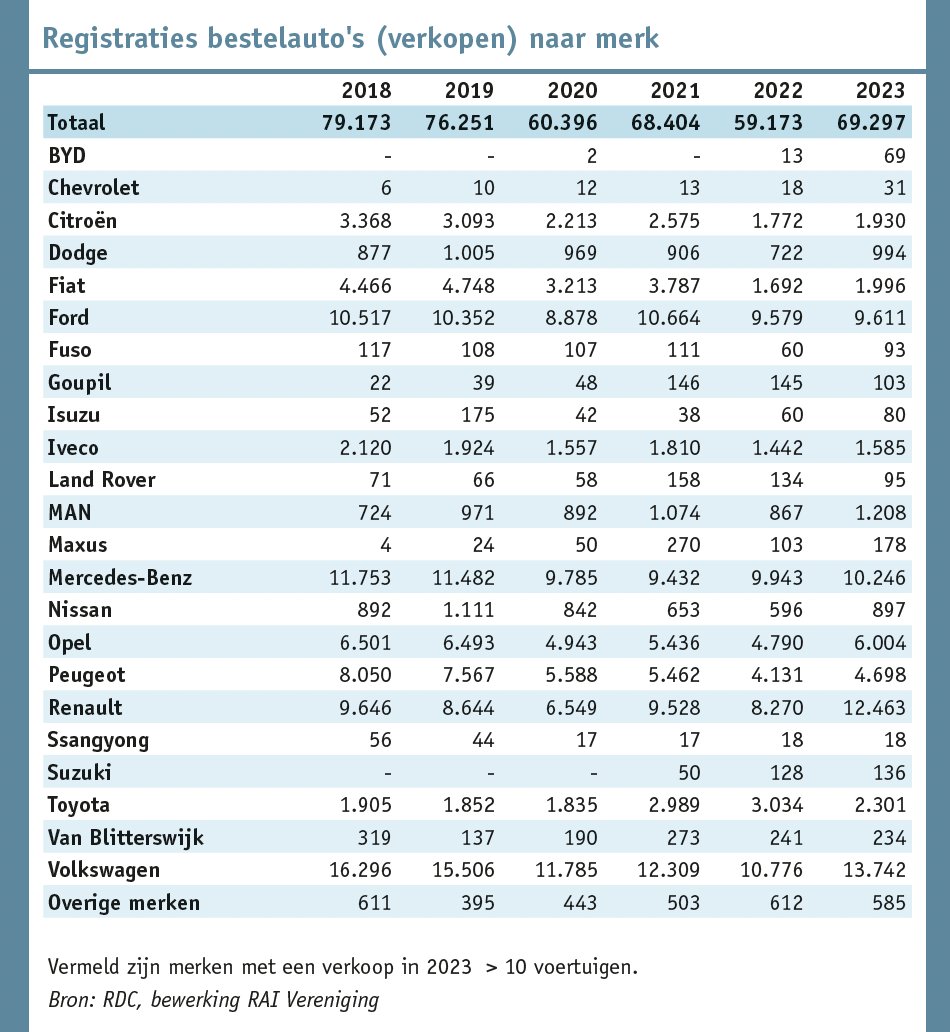

The high projection estimates that slightly more than 30,000 LEFVs will be operational in the Netherlands by 2027. While relatively small compared to the current fleet of almost one million vans in the country, LEFVs are expected to be concentrated in specific logistics segments (like parcels) and dense urban areas. Major carriers have begun experimenting with diversifying their vehicle fleets in city logistics, incorporating LEFVs. These vehicles offer a swift transition to clean, electric-powered options and flexibility in navigating crowded and car-free areas. However, a drawback is that the current production batches make them relatively more expensive than larger-scale production vehicles.

Dutch market for LEFV towards 2027

Safety, comfort, flexibility, and cost will remain pivotal in selecting vehicle types. In many aspects, the conventional van, also available with a fully electric powertrain, holds a strong position compared to LEFVs. A small but growing market exists for pedal-assisted and fully electric vehicles, especially among users who have optimized their distribution networks for specific distances and cargo volumes. These vehicles are compact, flexible, energy-efficient, and have lower driver’s license requirements.

Yet suppliers face the challenge of providing low-cost yet reliable vehicles. The wide variety of suppliers and LEFVs is accompanied by many breakdowns and high repair costs, impacting the total cost of ownership. Alignment with legislation is crucial for all LEFVs to support maintaining clean, accessible, and livable city centers and car-free neighborhoods. Harmonization at the EU level and clear municipal road access and parking rules are essential for successful integration.

Source:

LIGHT ELECTRIC FREIGHT VEHICLES – BEYOND THE HYPE?

Bram Kin TNO / HAN

Walther Ploos van Amstel Hogeschool van Amsterdam

Ruben Fransen TNO

Recent sales data the Netherlands (check Goupil and van Blitterswijk)